What Is Corporate Venture Capital and Why Is it Rising?

By Greg Kahn

Emerging Tech Exchange

Founder & CEO

Published on August 29, 2023

In the ever-evolving landscape of investment, a powerful trend has emerged: the ascendancy of Corporate Venture Capital (CVC). This strategic maneuver, driven by the need to balance short-term financial gains with visionary long-term aspirations, has captured the attention of both traditional investors and budding startup founders. But what exactly is CVC, and why is it on the rise?

Global Boost: Uptick Amidst Volatility

Corporate venture capital funding witnessed an impressive 4% surge in the last quarter, soaring to a staggering $14.6 billion, according to CB Insights data. This growth stands in stark contrast to the broader venture funding landscape, which experienced a dip. The uptick in CVC investment reveals a steadfast commitment by corporations to explore and invest in future possibilities.

CVCs: The Origin Story

CVC has deep roots in the history of American business. The first examples date back to the early 20th century. The formation of the earliest CVCs is attributed to Pierre S. du Pont, the president of chemical and plastics giant DuPont, who invested in General Motors (GM), which was considered an emerging automobile startup in 1914. A lot has happened in 100 years.

This investment proved lucrative as GM's stock value soared during World War I, driven by increased demand for vehicles.

The concept of corporate venture capital evolved further in the 1960s and 1970s. This period is considered the "first wave" of CVC. Companies like DuPont, 3M, and Alcoa began getting into external startup investments as a means of diversification. The push for diversification was fueled by anti-trust regulations, economic downturns, and a desire to expand into new markets.

The early corporate venture capitalists had three main motivations: the need for diversification, surplus cash to invest, and the success of venture capital in the nascent tech industry. This period marked a shift from focusing solely on internal innovation to embracing external startups, and corporations like Boeing, Ford, and General Electric joined the trend.

Exxon Enterprises became a symbol of CVCs at this time, investing in ventures far beyond its core oil business. However, as the 1970s energy crisis hit, anti-trust regulations loosened at the same time, and so the first wave of CVC began to decline. The early '70s economic downturn and changing business landscape led to a fading interest in diverse conglomerates, marking the end of this era.

The "second wave" of CVC emerged in the late 1970s and persisted until the mid-1990s. This period was characterized by the rise of personal computers and the growing influence of Silicon Valley. The success of tech giants like Microsoft and Apple inspired corporations to actively engage with emerging technologies.

During this era, corporate venture capital followed the lead of private venture capital. Regulatory changes in the late 1970s, such as reductions in the capital gains tax, sparked a resurgence in private VC investment. Corporate funds played a significant role in this growth, accounting for a notable portion of the total investment.

Companies used various models for CVC, including investing in independent VC firms, forming client-based funds, and establishing internally managed CVC funds. The motivations remained consistent with the first wave, seeking access to new technologies and exploring adjacent markets.

The second wave of CVC laid the foundation for the modern landscape of corporate venture capital, demonstrating that engaging with innovative startups could drive strategic growth and profitability. As the tech industry grew and entrepreneurial spirit flourished, CVC became an integral part of corporate strategies, shaping industries and fostering innovation well into the 21st century.

Navigating the Future of CVCs: The Surge Is On

As market uncertainties ebb and flow, the challenge of harmonizing short-term demands with long-term visions has become a delicate art. This intricate dance has given birth to the phenomenon of corporate venture capital, where companies not only seek financial returns but also lay the foundations for transformative future endeavors.

In the tumult of market pressures, companies have found solace in the embrace of CVC. This isn’t just a financial move; it’s a strategic shift that is altering the investment landscape. Let’s break it down:

Visionary Moves: Anticipating Market Trends

At the heart of the corporate venture capital surge lies a strategic desire to gain early insights into market trends and technological shifts. This forward-looking stance positions companies at the forefront of industry evolution, transforming them from mere bystanders to pioneers of change.

Beyond Finance: A Platform for Transformation

CVC is about more than just financial transactions; it’s about cultivating strategic value. Take Johnson & Johnson as an example. Their venture practice expanded into the HIV-treatment market, catalyzing life-altering transformations and cementing their position as trailblazers in the health tech arena.

Cultivating Innovation: The Exploration Model

TDK Ventures, the venture capital arm of the Japanese electronics titan, exemplifies the exploration model, as a recent WSJ piece on CVCS pointed out. Their strategy involves strategic investments in startups aligned with their core business objectives. This audacious approach is steering energy transformation and digital innovation into uncharted territories.

Risk and Rewards: Rethinking Corporate Norms

CVC defies conventional norms by embracing calculated risks through smaller, riskier bets. This ethos encourages companies to maximize exceptional outcomes instead of merely minimizing risks.

Strategic Partnerships: Expert Guidance

Experienced guidance can often shape the trajectory of corporate ventures. The role of Mach49 Managing Partner Chris Cusack in steering TDK's venture strategy, as highlighted by a feature in The Wall Street Journal, is a prime example. Collaborative ventures with firms like Mach49 offer companies the invaluable opportunity to build potent growth engines. (Note: I’m a proud advisor to Mach49.)

Peering into the Future: Awaiting Market Rebounds

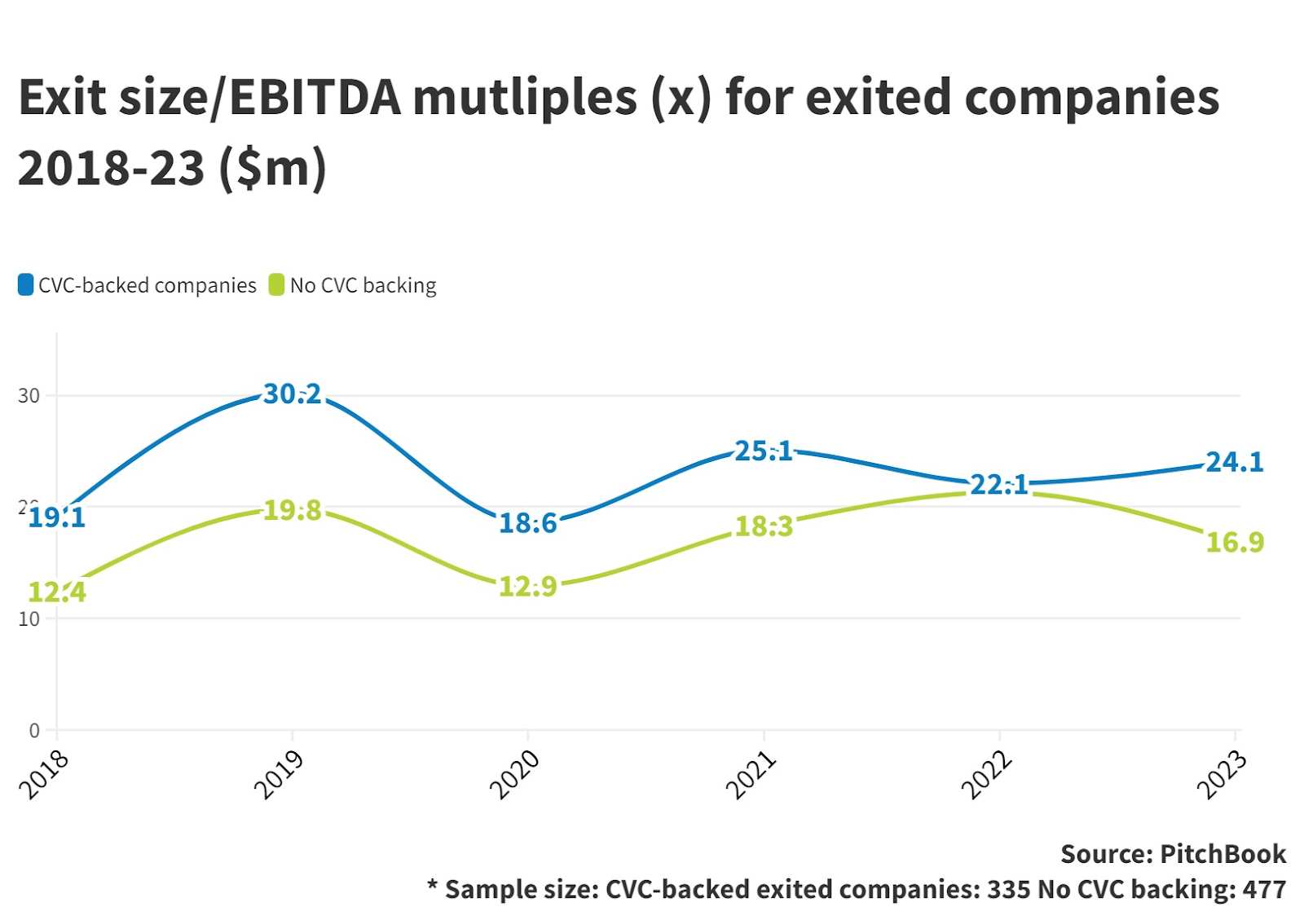

While the allure of promising returns lingers, the distribution of capital awaits the boon of market rebounds. Seasoned experts predict robust investment landscapes and the potential for monumental exits in 2023 and 2024.

This surge in CVC-backed funding isn't just a financial shift; it's a strategic pivot.

This next corporate venture capital phase is only just beginning. Propelled by larger economic changes and challenges, CVCs promise transformative power across diverse domains like health tech, climate tech, sustainability, mobility, artificial intelligence, spatial computing, and the evolving metaverse. As the corporate world sets its sights on a future of calculated risks and visionary investments, the stage is set for a new chapter in global finance and entrepreneurialism.

Greg Kahn

Emerging Tech Exchange

Founder & CEO